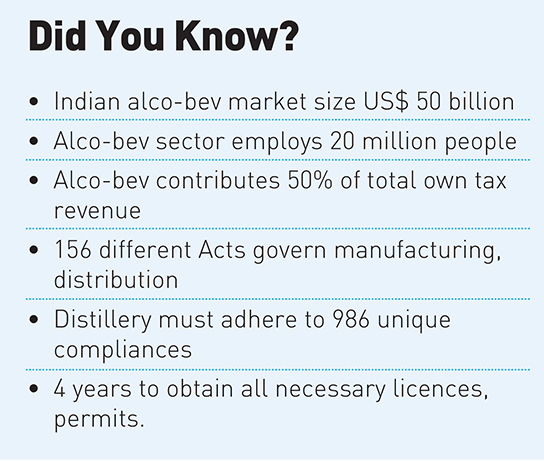

Beverage alcohol is one of India’s most under-appreciated industries, employing over 20 million people directly or indirectly, with a market size of over US$ 50 billion. An estimated 300 million individuals consume alco-beverages in the country, making it the third-largest market in the world.

With over 13 million Indians reaching the legal drinking age annually, it is predicted that the number of people who consume alcohol will reach 386 million by the end of the decade.

The growing demand is mainly attributed to rapid urbanisation, favourable demographics, changing social norms and consumer preferences, mainly among the younger population, rising disposable income for the middle-class population, and increased accessibility and availability of alcohol drinks.

Despite the growth, India only accounts for 0.27% of the world’s exported alcoholic beverages and 7.5% of its imported alcoholic beverages. Domestically, it accounts for 10-15% of the own tax revenue, placing it among the top three revenue sources for a state.

The industry can be broadly classified on the basis of kinds of beverage alcohol (distilled and fermented) and the nature of operations (manufacturing, distribution, storage and retail) of an enterprise.

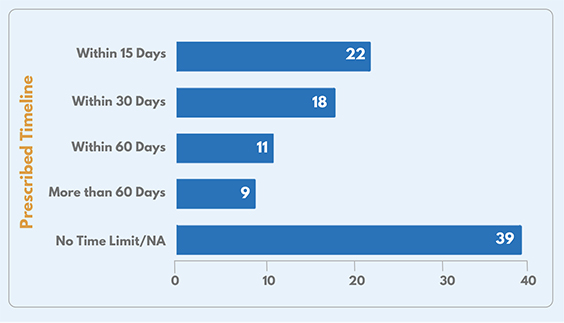

Split of licenses and permissions based on the prescribed timeline for their grant.

99 licences

For an entrepreneur looking to start from scratch with his/her own manufacturing facility in the state of Maharashtra, he/she needs to obtain at least 99 licences and permissions spread across four stages – setting up the business, pre-commissioning stage, post-commissioning stage, and post-production stage – before commencing operations.

Of these 99, the enterprise needs to renew 35 licences periodically. The approval timeline for these licences and permissions also varies, with some being granted within 15 days and some taking more than 60 days.

About 40% of these licences have no defined approval timeline and can take however much time as directed by the issuing authority. Consequently, it can take an average of 3-4 years for an enterprise to obtain all required licenses.

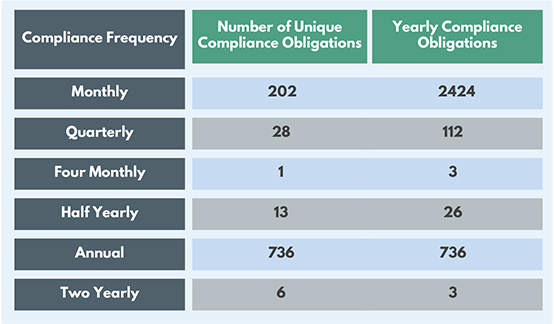

Once the business is up and running, the enterprise then must adhere to 986 regulatory requirements under 156 Acts. Furthermore, these requirements have varying levels of frequency for their compliance.

Around 202 of these filings need to be made on a monthly basis, creating 2,424 obligations in a year, whereas 736 need to be complied with once a year. Breaking down these requirements on the basis of types, we find that they consist of 127 returns/ submissions per year, 168 different forms and records, over 30 statutory payments, and more than 118 display obligations.

These include maintenance of records and returns, and filings under the specific state excise policy; Food Safety and Standard Act, 2006; Food Safety and Standard Rules, 2011; each state’s excise bonded warehouse rules; and state liquor licence rules, among others.

State variations

In addition, there are requirements related to the appointment of specific professionals, such as a safety officer, a medical officer, and a food safety advisor, among others; the creation of specific committees; periodic examinations, inspections, and machinery testing.

Apart from these, manufacturers also need to provide for the safety and welfare of their employees in the form of canteens, creches, first aid kits, and break rooms, to name a few.

Enterprises engaged in storing and distributing beverage alcohol in Maharashtra are again required to obtain right additional licences. In contrast, those engaged in retail sales can need up to 13 licences, depending on their business model.

Varying models of governance and pricing dominate the regulatory framework for alcohol across states. Since alcohol is listed under the State list of the Seventh Schedule and kept out of the ambit of goods and services tax, each state has its own set of policies, acts, rules and regulations that control the entire supply chain.

There are wide variations in state-wise policies in terms of requirements, frequency and timelines for policy revisions, the turn-around time for grant/ renewal of licences, and adoption of technology, among others.

Enterprises need to abide by state-specific Acts, rules and regulations such as the Bombay Prohibition Act (1949) and Bombay Foreign Liquor Rules (1953); Maharashtra Prohibition Act (1959) and Maharashtra Rectified Spirit Rules (1951); Maharashtra Country Liquor Rules (1973); and at the central-level Prevention of Food Adulteration Act (1954) and Prevention of Food Adulteration Rules (1955); and the Food Safety Standards (Alcoholic Beverages) Regulations (2018) among others.

Dissection of compliance obligations of an enterprise on the basis off requency of compliance

Entry barriers

Consequently, enterprises have to weather frequent and ad-hoc changes in policy and regulations. There is a heightened sense of uncertainty in the industry that has become an entry barrier for new players.

Even for the enterprises operating in the market, the lack of uniformity and the dynamic nature of the regulatory ecosystem affect their compliance management capabilities.

This effectively discourages and prevents enterprises from planning long-term investments and strategies. Because of the disparities in regulatory regimes between states, India has been segmented into more than 30 heterogeneous markets rather than a single market.

The US$ 50-billion alco-beverage sector contributes significantly to states’ tax revenues. With an ever-increasing consumer base that will continue to boost revenue and market size, it is pertinent to understand the ground realities of operating an enterprise in this space.

TeamLease Regtech, India’s leading regulatory technology (Regtech) solutions company, has released its report, titled ‘Simplifying Compliance Management for the Alco-Beverage Industry.’

The report provides an overview of the complexity of compliance and the challenges entrepreneurs and employers face in the alco-beverage industry. It also delves deep into the present regulatory framework and suggests actionable recommendations for enterprises and policymakers.

TeamLease Regtech’s Avacom is a digital compliance management system trusted by the likes of Zomato, Cognizant, ONGC and Alembic Pharma. For more information, write to sales@tlregtech.co.